Executive Summary

Real estate has long been a solid way to build wealth, offering multiple avenues for profit. Whether through direct property ownership, real estate investment trusts (REITs), or property development, there are various methods to earn income in this sector. This article explores the market trends, stock performances, value chain, supply chain, and provides a roadmap to starting in real estate. Both beginner and advanced investors will find strategies that align with their goals. By understanding the dynamics of the industry and applying practical steps, anyone can leverage real estate to grow their wealth.

General Information

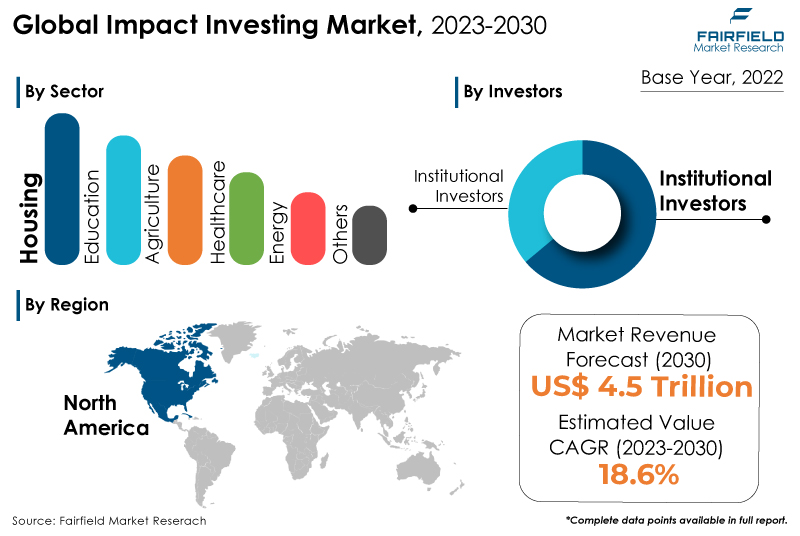

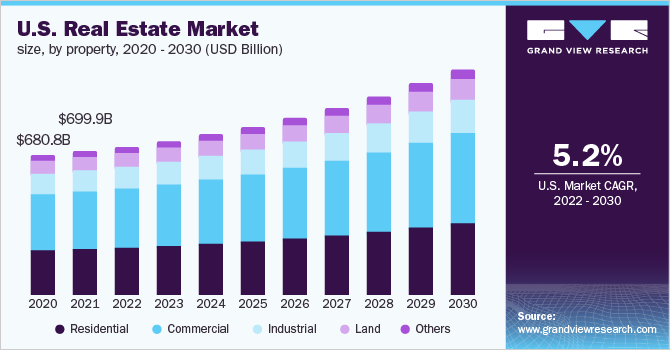

Market Trends

The real estate market has seen notable shifts due to various macroeconomic factors, such as interest rates, housing demand, and economic uncertainty. Here’s an overview of the current trends:

- Remote Work and Suburban Growth: The shift to remote work during the COVID-19 pandemic has created increased demand for suburban and rural properties. People are looking for more space and affordable living options, which is driving growth in these markets.

- Urban Redevelopment: Cities are undergoing redevelopment to accommodate new demand for mixed-use properties. Commercial spaces are increasingly being converted into residential units, creating new opportunities for investors.

- Short-Term Rentals: Platforms like Airbnb and Vrbo have created a boom in short-term rental investments. These properties can generate higher returns compared to long-term rentals, though they come with more management and legal complexities.

- Sustainability and Green Real Estate: Eco-friendly homes and commercial properties are gaining popularity. Investors are increasingly interested in energy-efficient buildings, driven by consumer demand and potential tax benefits.

- Rising Interest Rates: Higher interest rates have cooled the housing market in many regions, making it slightly harder for homebuyers and investors to secure financing. This is causing property prices to stabilize, offering opportunities for long-term investors.

Stock Performances

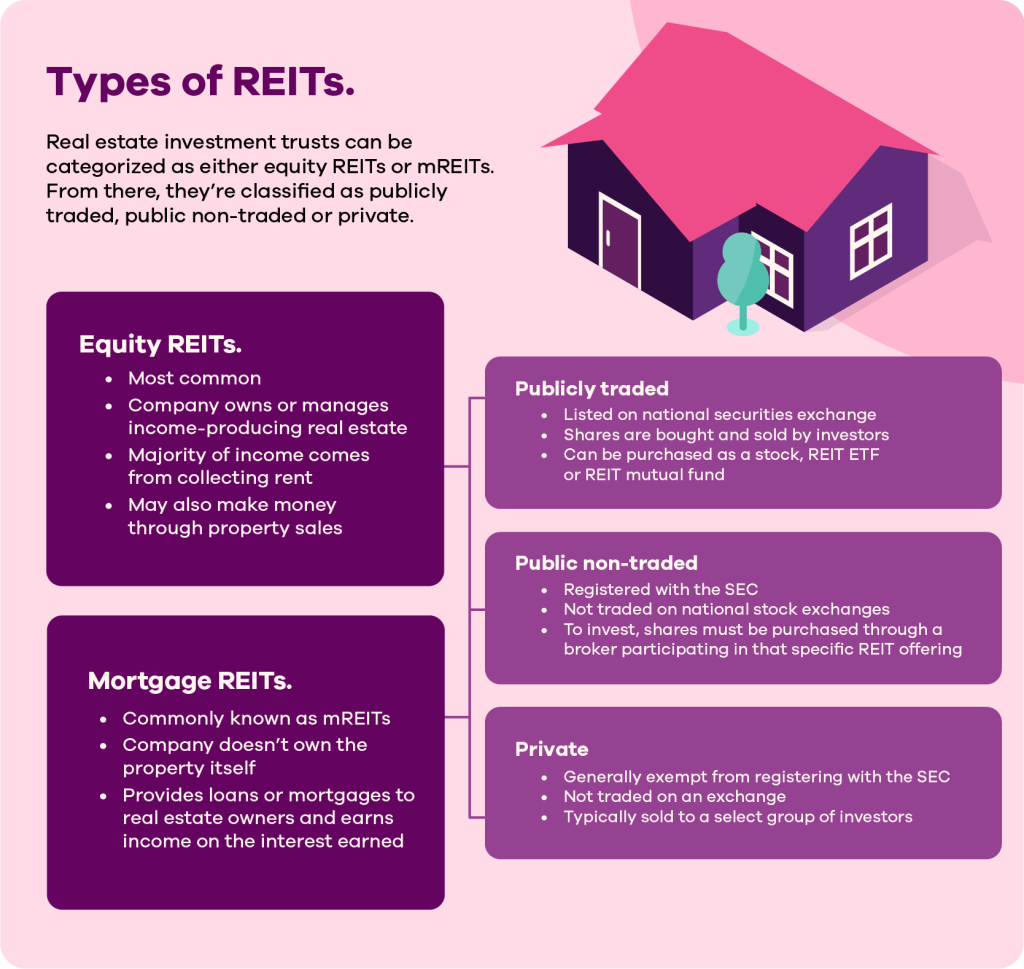

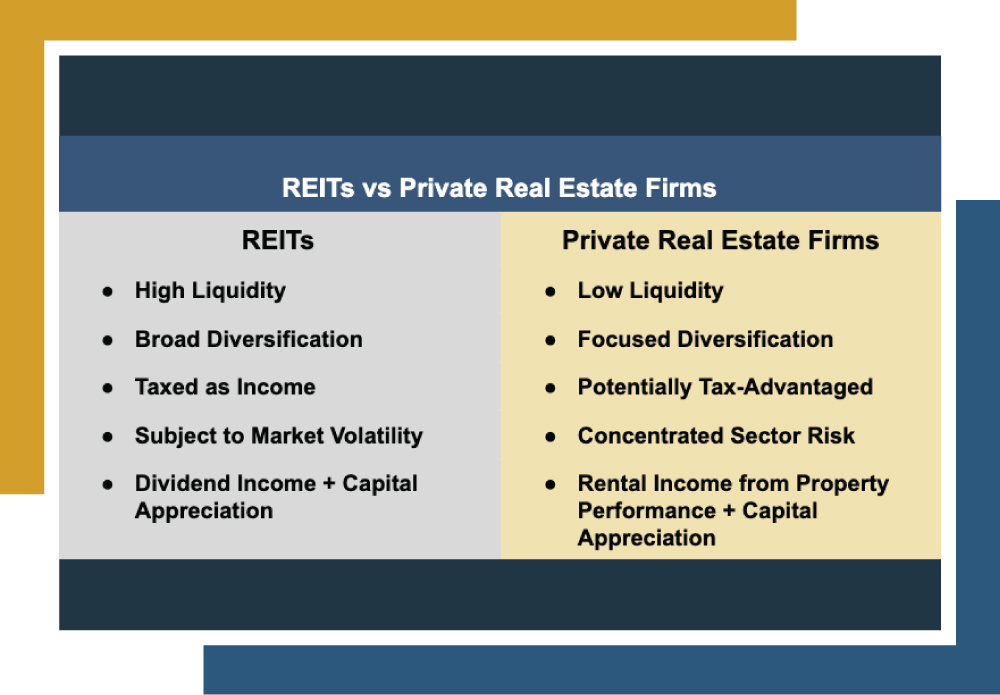

Investing in real estate stocks, particularly through Real Estate Investment Trusts (REITs), offers a way to tap into the real estate market without directly buying property. Here’s a look at stock performances:

- REITs Performance: Historically, REITs have delivered strong returns to investors. Many of them have rebounded after initial pandemic-related declines, and they continue to offer solid dividend yields.

- Top Performers: Well-established REITs like Prologis (PLD) and Realty Income Corporation (O) have consistently outperformed, showing resilience and growth. Investors who bought REITs at the market lows in 2020 saw significant capital appreciation.

- Market Volatility: While REITs are considered a more stable option compared to individual stocks, they are still subject to market volatility, especially in times of economic uncertainty. However, their dividend-paying nature often helps provide consistent income.

- Sector Trends: Different sectors of REITs perform differently—e.g., industrial REITs related to warehousing have seen growth due to the e-commerce boom, while retail REITs faced challenges with shifting shopping habits.

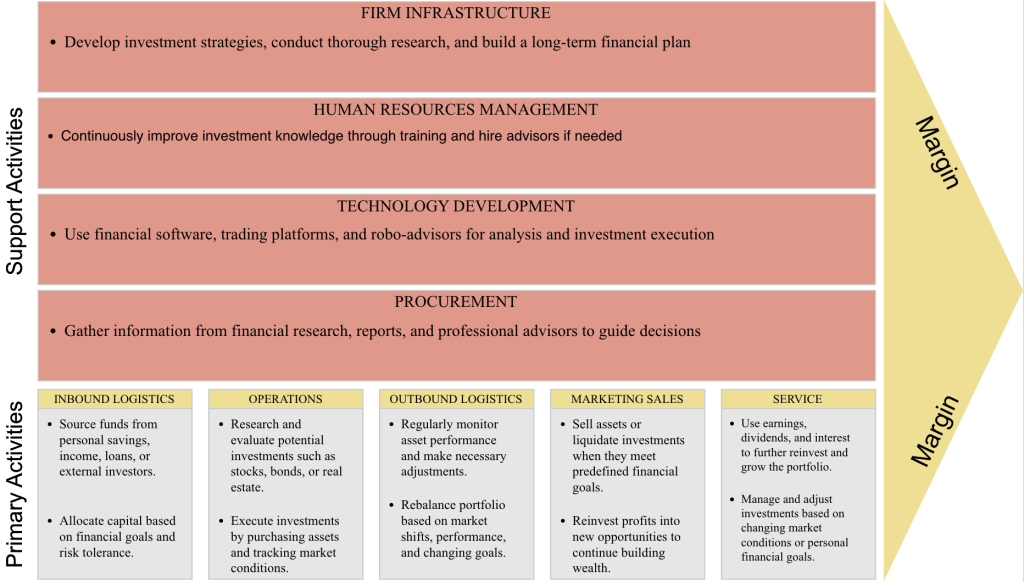

Value Chain of Real Estate

Inbound Logistics : Sourcing properties, gathering market data, and identifying investment opportunities.

Operations : Acquiring, developing, and renovating properties to add value.

Outbound Logistics : Marketing, selling, or leasing properties to potential buyers or tenants.

Marketing & Sales : Promoting properties through ads, networking, and online listings to attract buyers/tenants.

Service : Providing ongoing property management, maintenance, and customer service to tenants or buyers.

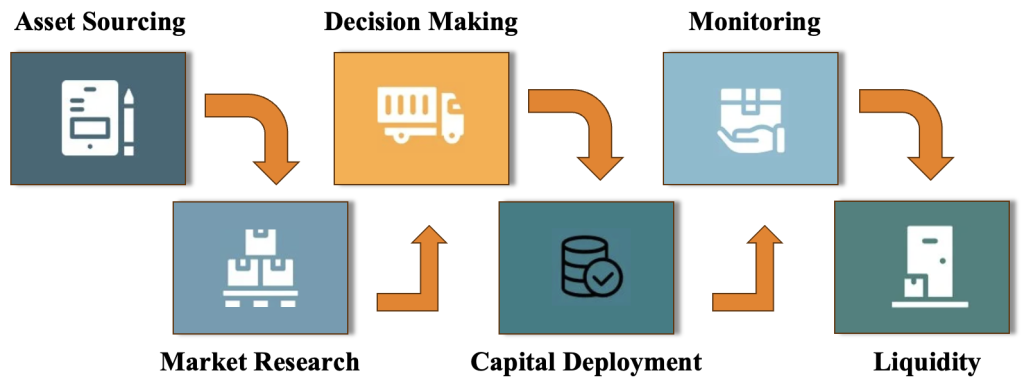

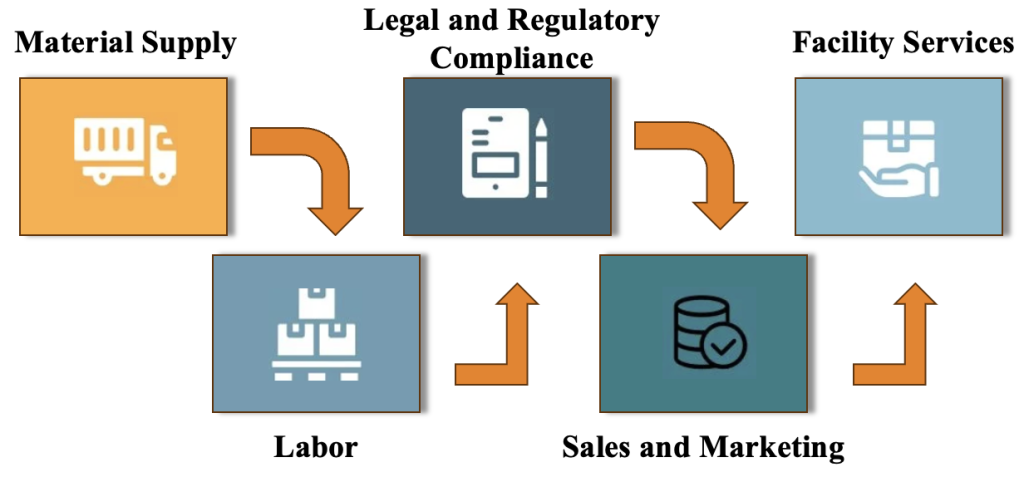

Business Environment (Supply Chain)

Material Supply: The construction phase requires a constant supply of materials like cement, steel, and timber. Suppliers and logistics companies ensure that construction projects stay on schedule.

Labor: Skilled labor, including construction workers, electricians, and architects, are essential to bringing real estate projects to life.

Legal and Regulatory Compliance: Legal teams and government agencies regulate the supply chain, ensuring that all properties meet zoning laws, safety standards, and building codes.

Sales and Marketing: Once construction is completed, the sales and marketing team works to sell or lease the property to the final customer.

Facility Services: Post-construction, the facility services team (cleaning, maintenance) ensures properties stay in good condition and meet tenant expectations.

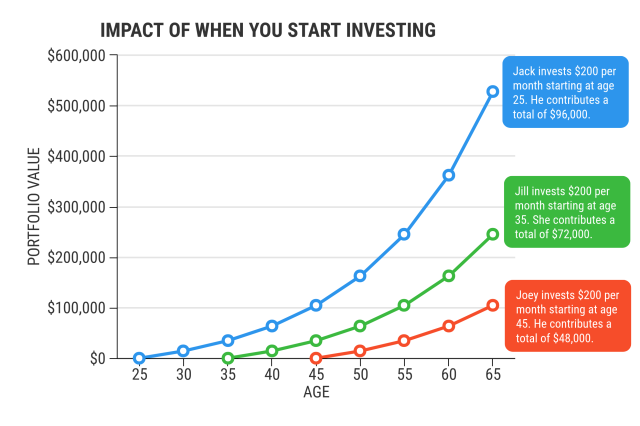

Introducing Steps

- Educate Yourself: Start with reading books, attending webinars, and taking courses on real estate. Understanding the basics of property investment, financing, and legal issues is crucial.

- Set Your Goals: Decide what type of real estate you want to invest in: residential, commercial, flipping, or rental properties.

- Build a Network: Connect with real estate agents, investors, contractors, and legal professionals who can provide valuable insights and help you along the way.

- Secure Financing: Understand your financing options, including loans, private investors, or using personal savings to fund your investments.

- Start Small: Begin with one or two properties to get the hang of the process. Gradually scale as you gain experience.

Advanced Information

Advanced Steps

- Leverage Financing: Use leverage (borrowed capital) to scale your investments. Real estate allows you to control more property with less initial capital through mortgages.

- Diversify Your Portfolio: Invest in different types of properties (e.g., residential, commercial, industrial) or explore international markets to minimize risks.

- Focus on Cash Flow: Invest in properties that generate steady cash flow through rentals. This provides long-term income while you build equity.

- Utilize Tax Benefits: Take advantage of tax deductions available to real estate investors, including deductions for depreciation, mortgage interest, and property taxes.

- Develop and Flip: After gaining experience, move into property development and flipping for higher returns. This requires more capital and risk but can be lucrative.

SASAL Can Support You

Insourcing

If you’re looking to bring real estate investing in-house within your corporation, SASAL is here to guide you every step of the way. With SASAL’s Real Estate Investment Strategy Service, you can receive personalized expert advice tailored to the real estate market, ensuring a smooth and successful integration of property investments into your company’s portfolio. Let SASAL help you navigate this process efficiently and make a lasting impact on your business growth.

Outsourcing

If you’re looking to invest in real estate but lack the time or specific knowledge, SASAL is here to support you by handling the entire process. By choosing to outsource your real estate investments, you can trust SASAL to manage everything from property sourcing to acquisition, ensuring you enjoy the results without the hassle. SASAL offers various services related to real estate investment, including Property M&A, Market Analysis, and Investment Strategy, but we can personalize our solutions to meet your unique needs and goals.

Practice

| Goal | Term | How to Achieve It |

|---|---|---|

| Buy Your First Investment Property | Short-Term | Start small with residential properties. Consider buying properties with equity already built-in. |

| Create Passive Income Stream | Mid-Term | Focus on rental properties that generate steady monthly cash flow. |

| Diversify Portfolio | Mid-Term | Invest in different real estate sectors (commercial, residential, etc.). |

| Develop and Flip Properties | Long-Term | Scale up with development projects and flip properties for profit. |

| Build a Real Estate Business | Long-Term | Expand by hiring a team for property management, sales, and acquisitions. |

Additional Resources or Information

- Websites:

- BiggerPockets – A platform with forums, articles, and tools for real estate investors.

- National Association of Realtors (NAR) – A resource for real estate professionals and investors