To gain 1,000 more followers on LinkedIn, optimize your profile with a professional photo and compelling headline, create valuable content regularly, engage with others by commenting and sharing, use relevant hashtags, join and participate in industry groups, network strategically with personalized connection requests, and leverage LinkedIn analytics to refine your strategy. Consistent application of these strategies will help you grow your following.

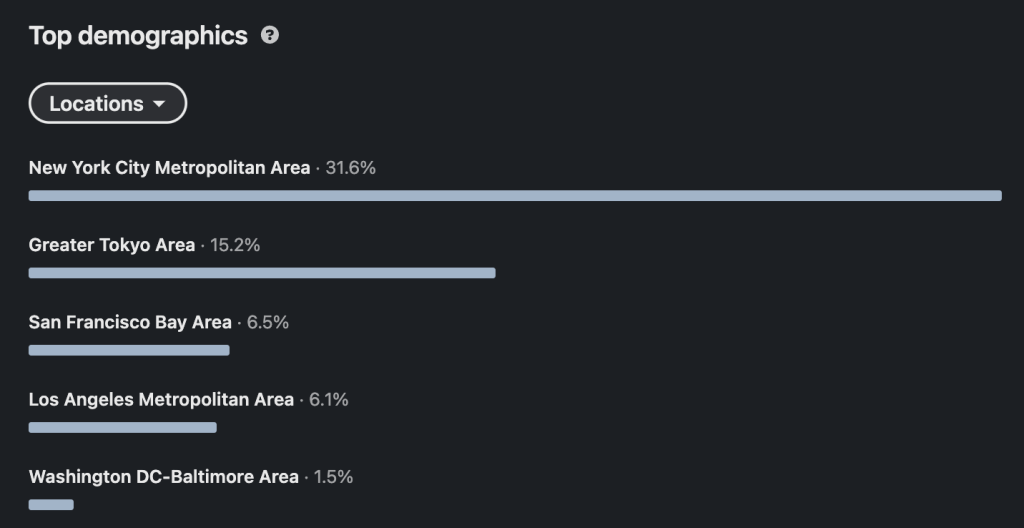

How to Maximize Google Advertisement to the New York Market

If you would like to submit the advertisement

Other Articles

How to start Mergers and Acquisitions in the US

Corporate Strategy Planning

Experience as an intern for now in SASAL

How to invest Private Corporations in the New York

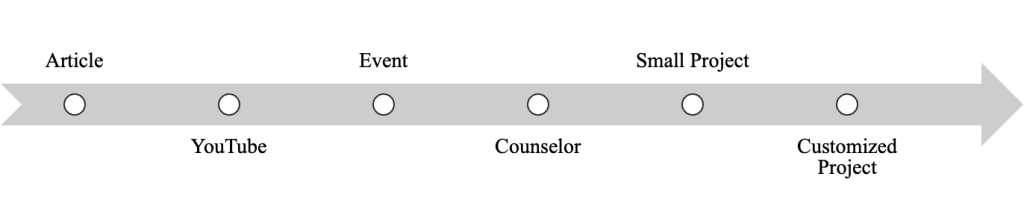

SASAL, INC. is based in the New York City Markets. We use the SASAL connection to support your investment. SASAL, INC is not VC, so we can introduce the corporation to support it. For a corporate introduction, you need to contact a counselor service. Those are the recommended support from SASAL in the counseling service range.

- Share Information on LinkedIn with your representative picture.

- Take a video of your corporation’s advertised video as a review of the counselor service and share it on YouTube.

By considering both sides of a situation, SASAL doesn’t introduce the corporation through private communication after hearing your corporation’s information. Basically, SASAL uses public tools like SNS because there are already established connections. However, if there are past consultations from the start-up corporation to SASAL about investment, SASAL can introduce the corporation through self-communication.

Addition

- When you would like to market in New York, or if there are some questions about strategy, we can answer them in the range of counselor services.

- SASAL can get a consultation from the counselor page if there is another demand, like due diligence or something else.

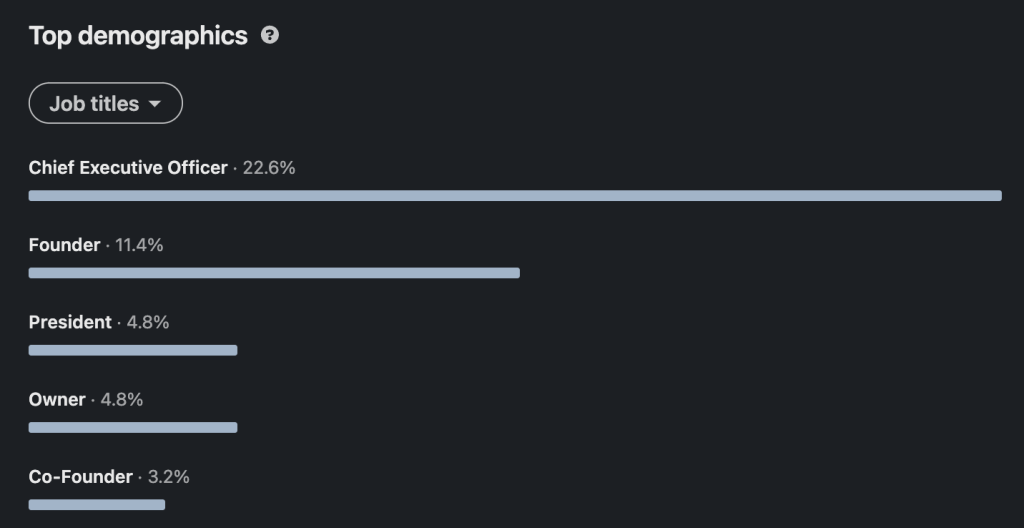

SASAL, INC’s SNS STATUS (Oct, 2024)

Corporate Account

CEO Account

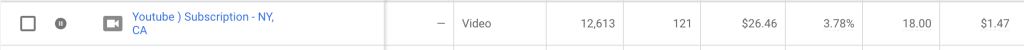

YouTube

Talking about YouTube, we are not sharing the dashboard information because of the YouTube policy.

Other Articles

Digital Strategy

How to reflect Business Due Diligence in Valuation

Business Strategy Planning

How to make use of Investment and Financing

Each type of investment corporation plays a unique role in the financial ecosystem, catering to different stages of company growth and investment strategies. Investment banks facilitate capital raising and provide advisory services, private equity firms focus on mature companies needing restructuring, venture capital firms invest in high-growth startups, and corporate venture capital entities seek strategic synergies with innovative startups. Understanding these differences can help investors and entrepreneurs navigate the complex world of finance more effectively.

Understanding the distinction between investment and financing is crucial for effective financial management. Investment decisions determine how to best allocate capital to maximize returns, while financing decisions determine how to obtain the necessary funds to support these investments and operations. By clearly distinguishing between these two concepts, businesses and investors can make more informed decisions that align with their strategic goals and financial objectives.

Difference Between Investment and Financing

In the world of finance, the terms “investment” and “financing” are often used interchangeably, but they refer to distinct activities with different objectives and implications. Understanding the difference between these two concepts is crucial for effective financial management and strategic decision-making. Let’s explore what sets investment and financing apart.

Investment: Allocating Resources for Future Gains

Purpose: The primary goal of investment is to allocate resources—typically capital—into assets or projects that are expected to generate returns over time. Investments are made with the expectation of future gains, such as income, appreciation, or both.

Key Activities:

- Capital Expenditures: This involves purchasing physical assets like machinery, buildings, or technology to enhance production capacity or efficiency.

- Securities: Investors buy stocks, bonds, or other financial instruments to earn dividends, interest, or capital gains.

- Research and Development (R&D): Companies invest in innovation and new product development to drive future growth.

- Real Estate: Acquiring property for rental income or appreciation is a common investment strategy.

Risk and Return: Investments typically involve varying levels of risk, with the potential for higher returns associated with higher risk. The goal is to maximize returns while managing risk effectively.

Time Horizon: Investments are generally made with a long-term perspective, focusing on future benefits and growth. This long-term view helps investors ride out short-term market volatility and capitalize on compounding returns.

Financing: Raising Capital to Fund Operations

Purpose: Financing involves raising capital to fund the operations, investments, and growth of a business. It focuses on how to obtain the necessary funds to support business activities and investments.

Key Activities:

- Equity Financing: This involves raising capital by issuing shares of stock, effectively selling ownership stakes in the company to investors.

- Debt Financing: Companies borrow funds through loans, bonds, or other debt instruments, which require repayment with interest over time.

- Internal Financing: Using retained earnings or profits generated by the business to fund operations and investments is a common practice.

- Hybrid Financing: Combining elements of both equity and debt, such as issuing convertible bonds or preferred shares, can provide flexible financing options.

Cost and Obligation: Financing decisions involve costs, such as interest payments on debt or dilution of ownership with equity. The choice between debt and equity financing affects the company’s capital structure and financial obligations.

Time Horizon: Financing can be short-term (e.g., working capital loans) or long-term (e.g., issuing bonds or equity). The time horizon depends on the nature of the funding needs and the company’s strategic goals.

The type of the investment

Government Funding

Governments around the world play a crucial role in supporting businesses through various funding mechanisms. These funds are designed to stimulate economic growth, foster innovation, and achieve strategic national objectives. Here, we delve into the different types of government funding available to corporations.

1. Grants

Grants are non-repayable funds provided by the government to support specific projects or activities. They are often awarded to promote research and development, innovation, and public services.

- Research Grants: These grants are aimed at supporting scientific research and technological development. Universities, research institutions, and private companies can apply for these funds to advance their research projects.

- Innovation Grants: Designed to support startups and companies developing new technologies, innovation grants help bring groundbreaking ideas to market.

- Infrastructure Grants: These funds are allocated for the construction and maintenance of public infrastructure such as roads, bridges, and public facilities, ensuring the development of essential services.

2. Subsidies

Subsidies are financial assistance provided to reduce the cost of goods and services, making them more affordable and encouraging production and consumption.

- Agricultural Subsidies: These subsidies support farmers by stabilizing food prices and ensuring food security. They help farmers manage the costs of production and maintain a stable supply of agricultural products.

- Energy Subsidies: Financial aid for renewable energy projects aims to promote sustainable energy sources. These subsidies help reduce the cost of developing and deploying renewable energy technologies.

- Housing Subsidies: Assistance is provided to make housing more affordable for low-income families, ensuring access to safe and stable living conditions.

3. Tax Incentives

Tax incentives are reductions in tax obligations to encourage certain activities or investments. These can take various forms, including tax credits, deductions, and exemptions.

- R&D Tax Credits: These credits reduce the tax burden for companies investing in research and development, encouraging innovation and technological advancement.

- Investment Tax Credits: Incentives for businesses to invest in new equipment or facilities, helping them expand and modernize their operations.

- Employment Tax Credits: Reductions in taxes for companies that create new jobs or hire from specific groups, such as veterans or individuals from disadvantaged backgrounds.

4. Loans and Loan Guarantees

Governments provide loans or guarantee loans to reduce the risk for lenders and make it easier for businesses to access capital.

- Small Business Loans: Low-interest loans are offered to help small businesses start or expand. These loans provide the necessary capital for growth and development.

- Export Financing: Loans and guarantees support companies exporting goods and services, helping them enter and compete in international markets.

- Disaster Recovery Loans: Financial assistance is provided for businesses affected by natural disasters, helping them recover and rebuild.

5. Public-Private Partnerships (PPPs)

PPPs are collaborative agreements between governments and private sector companies to finance, build, and operate projects. These partnerships leverage the strengths of both sectors to deliver public services and infrastructure.

- Infrastructure Projects: Joint ventures are formed to build and maintain roads, bridges, and public transportation systems, ensuring the development of essential infrastructure.

- Healthcare Facilities: Partnerships are established to construct and manage hospitals and clinics, improving access to healthcare services.

- Educational Institutions: Collaborations are developed to build and operate schools and universities, enhancing educational opportunities.

6. Equity Investments

In some cases, governments may take an equity stake in companies, particularly in strategic industries or during economic crises.

- Sovereign Wealth Funds: Government-owned investment funds invest in a variety of assets, including corporate equity, to generate returns for future generations.

- Bailouts: During economic crises, governments may purchase equity in struggling companies to stabilize the economy and prevent widespread financial collapse.

Objectives of Government Funding

- Economic Development: Stimulating economic growth, creating jobs, and enhancing competitiveness are primary goals of government funding. By providing financial support, governments can help businesses expand and thrive.

- Innovation and R&D: Driving technological advancement and maintaining a competitive edge in global markets are key objectives. Government funding supports research and development efforts, fostering innovation.

- Strategic Interests: Securing national security, technological leadership, and energy independence are critical strategic goals. Investments in defense, technology, and energy sectors help achieve these objectives.

- Social and Environmental Goals: Achieving social objectives like affordable housing and environmental sustainability is also a priority. Government funding supports initiatives that improve quality of life and protect the environment.

Government funding supports businesses and achieves broader economic and social goals. Governments can foster innovation, drive economic growth, and address critical societal challenges by providing financial assistance, tax incentives, and strategic investments.

Investment Banks

Investment banks are financial institutions that assist companies in raising capital and provide advisory services for mergers and acquisitions (M&A). They are typically involved in underwriting new debt and equity securities, facilitating the sale of these securities, and helping companies navigate complex financial transactions.

Key Functions of Investment Banks:

- Capital Raising: Investment banks help companies issue new securities, such as stocks and bonds, to raise capital. This includes Initial Public Offerings (IPOs) and secondary offerings.

- Advisory Services: They provide strategic advice on M&A, restructurings, and other financial transactions, including valuation, negotiation, and deal structuring.

- Sales and Trading: These banks facilitate the buying and selling of securities for clients and for their own accounts, providing liquidity to the markets.

- Research: Investment banks conduct in-depth research on industries, companies, and financial instruments, offering valuable insights and recommendations to investors.

Private Equity (PE)

Private equity firms invest in companies that are not publicly traded, often acquiring controlling stakes with the aim of improving their operations and financial performance. These firms typically focus on mature companies that require restructuring or expansion.

Key Characteristics of Private Equity:

- Leveraged Buyouts (LBOs): PE firms often use borrowed funds to acquire companies, aiming to enhance their value through operational improvements.

- Operational Improvements: After acquisition, PE firms work on optimizing business processes, cutting costs, and restructuring management to boost profitability.

- Exit Strategies: PE firms seek to exit their investments profitably through IPOs, sales to other firms, or selling back to the original owners.

- Fund Structure: PE firms raise capital from institutional investors and high-net-worth individuals, pooling this capital into funds used for investments.

Venture Capital (VC)

Venture capital firms provide funding to startups and early-stage companies with high growth potential. They take on significant risk by investing in unproven companies but stand to gain substantial returns if these companies succeed.

Key Characteristics of Venture Capital:

- Stages of Investment: VCs invest in various stages of a startup’s lifecycle, from seed funding to later-stage funding for growth and expansion.

- Portfolio Management: VCs manage a portfolio of investments, spreading risk across multiple startups and providing ongoing support and resources.

- Exit Strategies: Successful exits for VCs include IPOs, acquisitions by larger companies, or secondary sales to other investors.

- Industry Focus: Many VC firms specialize in specific industries, leveraging their expertise and networks to support their portfolio companies.

Corporate Venture Capital (CVC)

Corporate venture capital involves large corporations investing in startups, often to gain strategic advantages such as access to new technologies or markets. CVCs combine financial and strategic goals, seeking both returns and synergies with the parent company’s core business.

Key Characteristics of Corporate Venture Capital:

- Strategic Investments: CVCs invest in startups that align with the parent company’s strategic objectives, such as innovation or market expansion.

- Integration and Synergies: CVCs look for opportunities to integrate the startup’s technology or products with the parent company’s operations, creating mutual benefits.

- Long-Term Perspective: CVCs may have a longer investment horizon compared to traditional VCs, focusing on strategic alignment rather than quick financial returns.

- Collaboration and Support: Startups backed by CVCs often benefit from the parent company’s resources, including expertise, infrastructure, and market access.

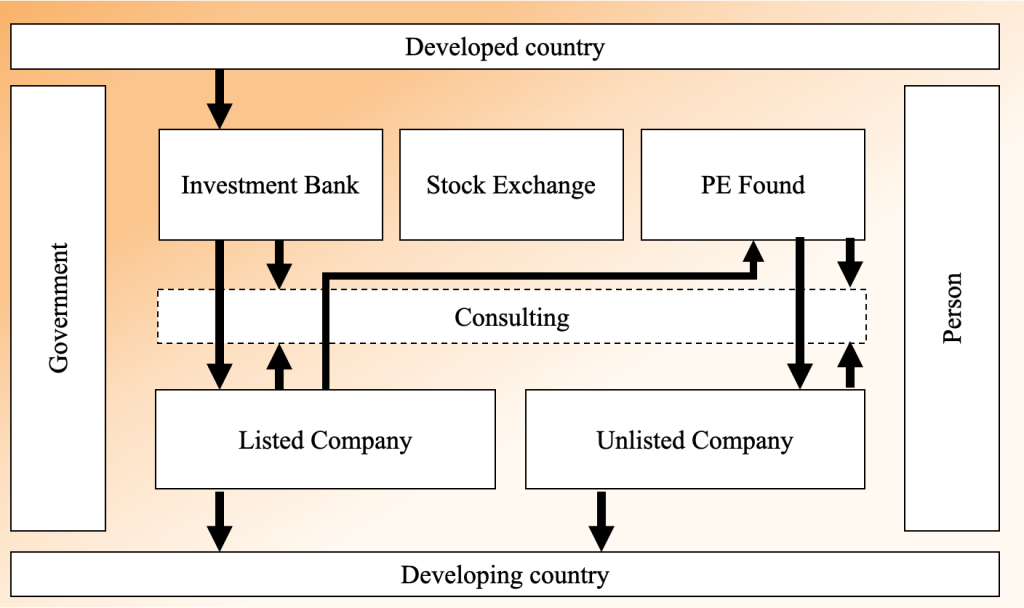

SASAL Support

This is the supply chain of the corporations. SASAL, INC is a strategy corporation; therefore, we can support both sides of the investment and business corporation. In the case of a business corporation, when you would not want to share the capital, SASAL, INC can support it as a strategy consulting firm. In the case of an investment corporation, SASAL, INC can support by searching the details of the market or corporation through business due diligence. SASAL, INC’s support is really flexible; first, please make a contract with the Counselor service. Thank you.

Other Articles

How to start the Advertisement with really safe

How to make use of Investment and Financing

How many companies are in the world?

The true business model of the PE Found

Venture Capital plays a crucial role in the startup ecosystem by providing the necessary funds and support for high-potential companies to grow and succeed. While it comes with its own set of risks and challenges, the benefits of VC funding can be significant, helping startups achieve their full potential and make a lasting impact on their industries.

Both Venture Capital and Corporate Venture Capital play crucial roles in the startup ecosystem, but they have different objectives and approaches. VCs are primarily driven by financial returns and invest in a wide range of industries. CVCs, on the other hand, seek to achieve strategic benefits for their parent corporations in addition to financial gains. They focus on startups that can complement or enhance the corporation’s existing business.

The choice between VC and CVC funding depends on the startup’s goals, industry, and the type of support they seek. Startups looking for strategic partnerships and access to corporate resources may prefer CVC funding, while those seeking purely financial backing and broader industry connections may opt for traditional VC funding.

What is Venture Capital?

Venture Capital (VC) is a form of private equity financing that investors provide to startups and small businesses with high growth potential. These investors, known as venture capitalists, typically invest in exchange for equity, or ownership stakes, in the companies. This type of financing is crucial for startups that may not have access to traditional financing options like bank loans.

How Does Venture Capital Work?

- Raising Funds: Venture capital firms raise money from institutional investors and high-net-worth individuals, known as limited partners (LPs). These funds are managed by general partners (GPs) who are responsible for making investment decisions. The process of raising a venture capital fund involves convincing these LPs of the potential returns on their investment.

- Investment Process: Once the fund is raised, the VC firm looks for promising startups to invest in. This involves a rigorous process of due diligence, where the firm evaluates the startup’s business model, market potential, team, and financial projections. If the startup passes this evaluation, the VC firm will negotiate the terms of the investment, including the amount of capital to be invested and the equity stake to be received in return.

- Stages of Investment:

- Seed Stage: This is the initial stage of funding, where the startup is still in the idea or prototype phase. The capital provided at this stage is used to develop the product and validate the business model.

- Early Stage: At this stage, the startup has a working product and some initial market traction. The funding is used to scale operations, hire key staff, and enter new markets.

- Growth Stage: This stage involves larger investments to expand the business further, increase market share, and prepare for an exit strategy. The company is usually generating significant revenue but may not yet be profitable.

- Equity Stake: In return for their investment, VCs receive equity in the company. This means they own a portion of the company and have a say in its strategic decisions. The size of the equity stake depends on the amount of capital invested and the valuation of the company at the time of investment.

- Exit Strategy: VCs aim to eventually sell their equity stake for a profit. This can happen through an Initial Public Offering (IPO), where the company goes public and its shares are listed on a stock exchange, or through an acquisition, where the company is bought by another firm. Another exit option is a buyout, where the company’s founders or other investors buy back the VC’s equity stake.

Benefits of Venture Capital

- Access to Capital: VC provides startups with the necessary funds to grow and scale their operations. This is especially important for startups that may not have access to traditional financing options.

- Expertise and Mentorship: VCs often bring valuable industry experience and strategic guidance to the startups they invest in. This can help the startup navigate challenges and make better business decisions.

- Networking Opportunities: Startups gain access to the VC’s network of partners, customers, and other resources. This can open doors to new business opportunities and collaborations.

Risks and Challenges

- Equity Dilution: Founders must give up a portion of their ownership in the company in exchange for VC funding. This can dilute their control over the company.

- High Expectations: VCs expect significant returns on their investments, which can create pressure on startups to grow rapidly and achieve high valuations.

- Loss of Control: With equity comes influence, and VCs may have a say in major business decisions. This can sometimes lead to conflicts between the founders and the investors.

Examples of Venture Capital Success

Many well-known companies, such as Google, Facebook, and Uber, received venture capital funding in their early stages. This funding helped them grow into the giants they are today. For instance, Google received its first VC investment from Sequoia Capital and Kleiner Perkins in 1999, which helped it scale its operations and eventually become one of the most valuable companies in the world.

The types of the PE Found

Venture Capital (VC)

Venture Capital is a form of private equity financing provided by investors to startups and small businesses with high growth potential. Here are the key aspects of VC:

- Primary Goal: The main objective of VCs is to achieve high financial returns through an eventual exit, such as an Initial Public Offering (IPO) or acquisition. VCs invest in startups with the expectation that these companies will grow rapidly and provide substantial returns on their investments.

- Funding Source: VCs raise funds from institutional investors and high-net-worth individuals, known as limited partners (LPs). These funds are managed by general partners (GPs) who are responsible for making investment decisions. The process of raising a venture capital fund involves convincing these LPs of the potential returns on their investment.

- Investment Process: Once the fund is raised, the VC firm looks for promising startups to invest in. This involves a rigorous process of due diligence, where the firm evaluates the startup’s business model, market potential, team, and financial projections. If the startup passes this evaluation, the VC firm will negotiate the terms of the investment, including the amount of capital to be invested and the equity stake to be received in return.

- Stages of Investment:

- Seed Stage: This is the initial stage of funding, where the startup is still in the idea or prototype phase. The capital provided at this stage is used to develop the product and validate the business model.

- Early Stage: At this stage, the startup has a working product and some initial market traction. The funding is used to scale operations, hire key staff, and enter new markets.

- Growth Stage: This stage involves larger investments to expand the business further, increase market share, and prepare for an exit strategy. The company is usually generating significant revenue but may not yet be profitable.

- Equity Stake: In return for their investment, VCs receive equity in the company. This means they own a portion of the company and have a say in its strategic decisions. The size of the equity stake depends on the amount of capital invested and the valuation of the company at the time of investment.

- Exit Strategy: VCs aim to sell their equity stake for a profit eventually. This can happen through an Initial Public Offering (IPO), where the company goes public and its shares are listed on a stock exchange, or through an acquisition, where another firm buys the company. Another exit option is a buyout, where the company’s founders or other investors buy back the VC’s equity stake.

Corporate Venture Capital (CVC)

Corporate Venture Capital is a form of venture capital where large corporations invest in startups. Here are the distinguishing features:

- Primary Goal: While financial returns are important, CVCs also aim to achieve strategic benefits for the parent corporation. This includes gaining access to new technologies, products, or services that can enhance their operations or provide a competitive edge. CVCs often look for startups that can complement or enhance their existing business.

- Funding Source: CVCs are funded by a single corporation, which acts as a limited partner. The parent corporation plays a significant role in the CVC’s investment decisions and operations. This close relationship allows the parent corporation to leverage the innovations and technologies developed by the startups.

- Investment Process: Similar to traditional VCs, CVCs conduct due diligence to evaluate the potential of startups. However, the evaluation criteria also include the strategic fit with the parent corporation’s goals and objectives. The terms of the investment are negotiated to align with both the financial and strategic interests of the corporation.

- Stages of Investment:

- Seed Stage: CVCs may invest in very early-stage startups to gain early access to innovative technologies and ideas.

- Early Stage: Investments at this stage help startups scale their operations and develop products that align with the corporation’s strategic interests.

- Growth Stage: Larger investments are made to help startups expand their market presence and integrate their solutions with the corporation’s existing operations.

- Equity Stake: In return for their investment, CVCs receive equity in the startup. This equity stake allows the corporation to influence the startup’s strategic direction and ensure alignment with its own goals. The size of the equity stake depends on the amount of capital invested and the valuation of the startup.

- Strategic Collaboration: CVCs often facilitate collaborations between the startup and the parent corporation. This can include joint development projects, pilot programs, and access to the corporation’s resources and customer base. These collaborations can accelerate the startup’s growth and provide valuable insights to the corporation.

- Objective: VCs focus primarily on financial returns, while CVCs seek both financial and strategic benefits. CVCs aim to enhance the parent corporation’s competitive position and drive innovation within the company.

- Funding Source: VCs raise funds from multiple investors, whereas CVCs are funded by a single corporation. This difference in funding sources influences the investment strategies and objectives of each type of investor.

- Investment Criteria: VCs evaluate startups based on their financial potential and growth prospects, while CVCs consider both financial potential and strategic fit with the parent corporation. This means CVCs may invest in startups that align with the corporation’s long-term goals, even if the immediate financial returns are not as high.

- Support and Resources: CVCs can offer more extensive resources and industry-specific expertise due to their connection with the parent corporation. This includes access to research and development facilities, marketing channels, and established customer relationships. VCs, on the other hand, provide general business guidance and connections within the broader investment community.

Strategy Consulting Values to VC and CVC

Market Analysis and Insights

Strategy consulting firms offer comprehensive market analysis, providing VCs and CVCs with deep insights into industry trends, competitive landscapes, and emerging opportunities. This information is crucial for making informed investment decisions. By understanding market dynamics, VCs and CVCs can identify high-growth sectors and potential disruptors, allowing them to invest strategically and stay ahead of the competition.

Investment Strategy Development

Consulting firms assist in developing robust investment strategies that align with the corporation’s long-term goals. This includes identifying potential investment targets, evaluating their strategic fit, and assessing the risks and returns. A well-crafted investment strategy ensures that the corporation’s resources are allocated efficiently and that investments are made in companies with the highest potential for growth and profitability.

Due Diligence

Conducting thorough due diligence is a critical step in the investment process. Strategy consultants perform detailed financial analysis, market validation, and operational assessments of potential investments. This ensures the investment is sound and aligns with the corporation’s strategic objectives. By identifying potential risks and opportunities early on, consulting firms help VCs and CVCs make more informed and confident investment decisions.

Portfolio Management

After making an investment, consulting firms provide ongoing support to manage and optimize the portfolio. They offer strategic guidance to portfolio companies, helping them scale, improve operations, and achieve growth targets. This includes advising on business development, operational efficiency, and market expansion. Effective portfolio management maximizes investments’ value and ensures portfolio companies reach their full potential.

Innovation and Technology Scouting

For CVCs, staying ahead of technological trends is vital. Consulting firms help scout for innovative technologies and startups that complement or enhance the corporation’s capabilities. By identifying cutting-edge technologies and disruptive innovations, consulting firms enable CVCs to invest in companies that can drive future growth and maintain a competitive edge in the market.

Performance Measurement

Establishing metrics and benchmarks to measure the performance of investments is essential for tracking progress and ensuring that investments are delivering the expected returns. Consulting firms develop performance measurement frameworks that help VCs and CVCs monitor the success of their investments. This includes financial metrics, operational KPIs, and market performance indicators. Regular performance reviews allow for timely adjustments and improvements.

Strategic Partnerships and Alliances

Consulting firms facilitate strategic partnerships and alliances between the corporation and other entities, including startups, other corporations, and research institutions. These partnerships can drive innovation, open new business opportunities, and enhance the corporation’s strategic position. By leveraging their extensive networks and industry expertise, consulting firms help VCs and CVCs build valuable relationships that can lead to collaborative ventures and mutual growth.

Regulatory and Compliance Support

Navigating the regulatory landscape can be complex, especially when investing in different countries. Consulting firms provide expertise in regulatory compliance, ensuring that investments adhere to all relevant laws and regulations. This includes understanding local market regulations, intellectual property laws, and industry-specific compliance requirements. By mitigating regulatory risks, consulting firms help VCs and CVCs avoid legal pitfalls and ensure smooth operations.

Exit Strategy Planning

Planning and executing exit strategies is crucial to the investment lifecycle. Consulting firms help VCs and CVCs develop and implement exit strategies through IPOs, mergers, acquisitions, or other means. A well-planned exit strategy ensures that the corporation can maximize its investment value. Consulting firms guide timing, valuation, and negotiation to achieve successful exits and maximize returns.

The Support of the SASAL, INC

To the start-up

SASAL, INC is not VC & CVC; however, we have their connection; when you want to widen the VC connection, we can support you when you are the client.

To the VC & CVC

Before investing, SASAL, INC can check the market situation through business due diligence. First, please create a contract with the counselor service. You are able to save your budget; SASAL supports the buy-side, such as VC or Listed Corporation. Before investing, SASAL, INC can provide daily support through Counselor Service. When you would like to get packaged service, you can contract. Please make use of it. Thank you.

Other Articles

How to Maximize Google Advertisement to the South Asian Market

How to Maximize Google Advertisement to the New York Market

Things you need to consider before global transportation

How to save strategy cosultings’ fee by right negotiation

As a consulting firm, SASAL, INC. would like to share how to save the client’s budget when they ask the strategy consulting firm to take on the project.

Packaged Service

In each strategy, the corporation has a service package for efficiency. When the client asks for a job at a strategy consulting firm, please ask them to submit the package first before customizing it with an estimate.

Customize

After finishing the packaged service, it’s better to customize the Packaged Service Based on your direction. Sometimes, that is a waste of time. In that case, it’s better for you to ask them to give both sides of the packaged and customized project estimates.

How about SASAL, INC

In the case of SASAL, INC, all packaged services are on the client page. We can customize this by using our past case. To see the actual cost or details of the service, please contact the counselor service first.

Other Articles

What kinds of search engine in the world

How to reflect Business Due Diligence in Valuation

How to maximize the your corporation’s advertisement

How to make use of fundrasing

Corporations engage in fundraising for a variety of strategic reasons. Here are some detailed insights:

Reasons Corporations Try Fundraising

Capital for Growth

Fundraising is essential for securing the capital needed to expand operations, enter new markets, or develop new products. This capital infusion is crucial for staying competitive and driving long-term growth. For example, a tech company might raise funds to build new data centers or expand its product line.

Research and Development

Innovation requires significant investment. Fundraising provides the necessary funds for R&D, enabling companies to create cutting-edge technologies or improve existing products. Pharmaceutical companies, for instance, often raise funds to develop new drugs and conduct clinical trials.

Debt Management

Companies might raise funds to pay off existing debts, which can improve their balance sheets and reduce interest expenses. This financial restructuring can lead to better financial health and more favorable terms for future borrowing. For example, a corporation might issue new shares to pay down high-interest debt.

Operational Costs

During periods of rapid growth or economic downturns, companies may need additional funds to cover day-to-day operational expenses. This ensures that they can maintain smooth operations without compromising on quality or service. Retail chains, for instance, might raise funds to manage inventory and supply chain costs.

Strategic Acquisitions

Fundraising can provide the capital needed for mergers and acquisitions, allowing companies to grow through strategic purchases of other businesses. This can help them gain new capabilities, enter new markets, or eliminate competition. For example, a large corporation might raise funds to acquire a smaller competitor with valuable technology.

Building Resilience

Having a strong financial base helps companies weather economic uncertainties and unexpected challenges, ensuring they remain stable and resilient. This financial cushion can be crucial during economic downturns or industry disruptions. For instance, a company might raise funds to build a reserve that can be used during tough times.

Enhancing Credibility

Successfully raising funds can enhance a company’s credibility and reputation in the market, attracting more investors and business opportunities. It signals to the market that the company is a viable and promising investment. For example, a startup that successfully raises a significant amount of capital can attract further investment and partnerships.

SASAL, INC’s Support

SASAL, INC is able to introduce CVC to the client.

Other Articles

Optimization Strategy

How to operate Global Accounting with right way

How to monetize the YouTube within one month

How to start Mergers and Acquisitions in the US

Mergers and Acquisitions (M&A) are strategic decisions taken by companies to consolidate their assets, operations, and market presence. These transactions can significantly impact the business landscape, influencing market dynamics, competition, and economic growth. Mergers and Acquisitions are powerful tools for corporate growth and strategic realignment. While they offer numerous benefits, they also come with risks and challenges. Successful M&A transactions require careful planning, thorough due diligence, and effective integration strategies.

What is Mergers and Acquisitions

Mergers

A merger occurs when two companies agree to combine their operations and form a new entity. This process is typically mutual and involves the blending of resources, technologies, and market share. Mergers can be classified into several types:

- Horizontal Mergers: These occur between companies operating in the same industry and often direct competitors. The primary goal is to achieve economies of scale, reduce competition, and increase market share. For example, the merger between Daimler-Benz and Chrysler to form DaimlerChrysler.

- Vertical Mergers: These involve companies at different stages of the production process. For instance, a manufacturer merging with a supplier. The aim is to streamline operations, reduce costs, and improve supply chain efficiency. An example is the acquisition of Time Warner by AT&T.

- Conglomerate Mergers: These occur between companies in unrelated businesses. The objective is diversification, risk management, and leveraging synergies across different industries. An example is the merger between Walt Disney Company and American Broadcasting Company (ABC).

Acquisitions

An acquisition happens when one company purchases another. The acquired company may either be absorbed into the purchasing company or operate as a subsidiary. Acquisitions can be friendly or hostile:

- Friendly Acquisitions: These occur when the target company agrees to be acquired. The process is usually smooth, with both companies working together to finalize the deal. An example is Facebook’s acquisition of Instagram.

- Hostile Acquisitions: These occur when the target company does not want to be acquired. The acquiring company may go directly to the shareholders or use other tactics to gain control. An example is the acquisition of Cadbury by Kraft Foods.

Valuation in M&A

Valuation is a critical aspect of M&A. It involves determining the worth of the target company to ensure a fair price is paid. Several methods are used for valuation:

- Comparable Company Analysis (CCA): This method involves comparing the target company with similar companies in the industry. Key metrics such as price-to-earnings ratio, EBITDA, and revenue multiples are analyzed.

- Discounted Cash Flow (DCF): This method involves projecting the target company’s future cash flows and discounting them to present value using a discount rate. It provides an intrinsic value based on the company’s future earning potential.

- Precedent Transactions: This method involves analyzing past M&A transactions in the same industry. It helps in understanding the market trends and valuation multiples paid for similar companies.

Regulations and Legal Considerations

M&A activities are subject to various regulations to ensure fair competition and prevent monopolies. Antitrust laws play a crucial role in this regard. Regulatory bodies such as the Federal Trade Commission (FTC) in the United States and the European Commission in the EU review M&A transactions to ensure they do not harm consumers or stifle competition.

Strategic Considerations

Companies engage in M&A for several strategic reasons:

- Growth: M&A can provide rapid growth opportunities by acquiring new markets, technologies, and customer bases.

- Synergies: Combining operations can lead to cost savings, increased efficiencies, and enhanced capabilities.

- Diversification: M&A allows companies to diversify their product lines, services, and market presence, reducing dependency on a single market.

- Competitive Advantage: Acquiring competitors or complementary businesses can strengthen a company’s market position and competitive edge.

Challenges in M&A

Despite the potential benefits, M&A transactions come with challenges:

- Cultural Integration: Merging different corporate cultures can be difficult and may lead to conflicts and reduced employee morale.

- Regulatory Hurdles: Obtaining regulatory approvals can be time-consuming and may require significant concessions.

- Financial Risks: Overpaying for a target company or failing to achieve projected synergies can lead to financial losses.

- Operational Disruptions: Integrating operations can disrupt business activities and affect customer relationships.

SASAL, INC’s Support

SASAL recommends M&A for niche technologies. On the other hand, we do not recommend M&A to increase operational speed and efficiency. This is because acquisitions are labor-intensive and costly, and PMI is also expensive. As a result, we have seen many companies abandon acquired services because they cannot utilize them fully. SASAL recommends that clients consider whether or not to purchase a company based on its patentability, and our M&A support is designed to provide our clients with honest opinions. Our M&A support will provide our clients with an honest opinion.

Other Articles

How to maximize the your corporation’s advertisement

Corporate Strategy Planning

How to start the Advertisement with really safe

How to establish the efficient sales ways

To establish efficient sales ways

Establishing efficient sales strategies for your corporation involves several key steps. First, define clear sales goals using the SMART criteria (Specific, Measurable, Achievable, Relevant, Time-bound). Understand your Ideal Customer Profile (ICP) by researching and identifying the characteristics of your best customers. Streamline your sales processes by optimizing your sales funnel and using automation tools like CRM systems to manage leads and track interactions. Invest in continuous sales training and coaching to keep your team updated on the latest techniques. Align your sales and marketing teams to create a unified strategy, ensuring they share insights and coordinate campaigns. Leverage data and analytics to make informed decisions and monitor key performance indicators (KPIs) such as conversion rates and customer acquisition costs. Focus on building strong customer relationships through value-based selling and regular feedback collection. Optimize resource allocation by prioritizing high-value leads and budgeting effectively. Utilize technology, including CRM systems and sales enablement tools, to enhance your sales efforts. Finally, commit to continuous improvement by regularly reviewing and adapting your strategies based on new insights and market changes. By following these steps, you can create a more efficient and effective sales process that drives growth and improves customer satisfaction.

Outbound Sales Ways

Outbound sales involve proactively reaching out to potential customers through methods like cold calling and email campaigns, while inbound sales rely on attracting customers who initiate contact through marketing efforts like content creation and SEO. Outbound sales target prospects who may not be familiar with the company, whereas inbound sales engage with prospects already interested in the company’s offerings. Both strategies can be effective, often used together to maximize reach and sales potential.

Email Outreach

- Subject Lines: Craft compelling subject lines that grab attention and encourage the recipient to open the email.

- Personalization: Personalize the email content to address the recipient’s specific needs and interests.

- Follow-Up Sequences: Develop a series of follow-up emails to nurture leads who don’t respond to the initial outreach.

In SASAL, INC, there are DM services. SASAL, INC is doing DM through LinkedIn. If the client asks us to operate e-mail outreach, we are able to do it instead of your corporation. When you would like to contract cold sales of SASAL, INC, you need to make a contract counselor service.

Social Selling

- Building a Presence: Establish a strong presence on social media platforms relevant to your industry.

- Engagement: Engage with potential customers by commenting on their posts, sharing valuable content, and participating in discussions.

- Content Sharing: Share content that showcases your expertise and provides value to your audience.

In the case of SASAL, INC, we operate on LinkedIn.

Networking Events

- Preparation: Research the event and the attendees to identify potential prospects and prepare your pitch.

- Elevator Pitch: Develop a concise and compelling elevator pitch that clearly communicates your value proposition.

- Follow-Up: After the event, follow up with the contacts you made to continue the conversation and build relationships.

In the case of SASAL, INC, we hold the SASAL Conference every month. This is free when you join online. Please feel free to ask everything.

Referral Programs

- Incentives: Create a referral program that incentivizes your existing customers to refer new prospects.

- Communication: Clearly communicate the benefits of the referral program to your customers and make it easy for them to participate.

- Tracking: Use tools to track referrals and measure the success of your program.

Webinars and Online Workshops

- Content: Develop informative and engaging content that addresses the pain points of your target audience.

- Promotion: Promote your webinars through various channels, including email, social media, and your website.

- Engagement: Engage with attendees during the webinar through Q&A sessions and interactive polls.

Lead Scoring

- Criteria: Define criteria for scoring leads based on their behavior and engagement with your brand.

- Automation: Use automation tools to score leads and prioritize follow-up efforts.

- Nurturing: Develop nurturing campaigns for leads that are not yet ready to convert.

Inbound Sales Ways

Content marketing

- Blogs: attract prospects by providing useful information and industry trends.

- White papers: gain prospects’ trust by providing in-depth guides and research findings.

Search Engine Optimization(SEO)

- Optimize the content of your website or blog for search engines and ensure it ranks highly for the keywords your prospects search for.

Social networking (social media)

- Disseminate information and actively communicate with your followers on platforms such as Facebook, Twitter and LinkedIn.

Webinars (online seminars)

- Provide expert knowledge and product demonstrations online and create opportunities to interact directly with prospective customers.

Email marketing

- Provide prospects with regular, useful information to keep them engaged.

SASAL Sales Way

This is customer flow, as an outbound sales sasal focuses on the LinkedIn communication. Based on the demand for the new connection, SASAL recommends those services. Every day, SASAL posts on LinkedIn, and by watching them, the followers can learn about profitable services. We aren’t doing Direct Mail or cold Calls for the visitors because they might be interested in us at first.

Other Articles

How to invest Private Corporations in the New York

How to collect so many people to the event

How to get the US working visa for business

How to operate Global Accounting with right way

Those are the things you need to consider before starting a global business. With information on SASAL, INC, we will explain global accounting.

Basic Information

1. Different Accounting Standards

There are two types of accounting standards: IFRS vs. GAAP. IFRS (International Financial Reporting Standards) is used by over 140 countries, including the European Union, Canada, and many Asian countries. IFRS aims to bring transparency, accountability, and efficiency to financial markets around the world. GAAP (Generally Accepted Accounting Principles) is primarily used in the United States. GAAP is more rules-based, whereas IFRS is principles-based. This means GAAP provides specific guidelines for various scenarios, while IFRS allows for more interpretation and judgment.

The Key Differences in the Accounting Standards are below.

- Revenue Recognition: IFRS uses a single model for revenue recognition, while GAAP has multiple standards.

- Inventory Accounting: IFRS prohibits the use of LIFO (Last In, First Out) method, which is allowed under GAAP.

- Development Costs: Under IFRS, development costs can be capitalized if certain criteria are met, whereas GAAP typically requires these costs to be expensed as incurred.

2. Currency Exchange Rates

The impact on Financial Statements is below. Translation Risk: When consolidating financial statements, the exchange rate used can significantly impact the reported results. Companies must decide whether to use the current rate, average rate, or historical rate. Transaction Risk: This arises from the actual exchange of currencies in business transactions. Companies need to manage this risk through hedging strategies like forward contracts or options.

Best Practices:

- Consistent Application: Use consistent methods for translating foreign currency transactions to ensure comparability.

- Disclosure: Clearly disclose the methods and rates used in financial statements to provide transparency to stakeholders.

3. Tax Regulations

Corporate Tax Rates vary widely between countries. For example, Ireland has a corporate tax rate of 12.5%, while the U.S. has a rate of 21%. Transfer Pricing Rules that govern the pricing of transactions between related entities in different countries. Compliance with local transfer pricing regulations is crucial to avoid penalties.

- Tax Planning: Engage in proactive tax planning to optimize the overall tax burden.

- Documentation: Maintain thorough documentation to support the tax positions taken, especially for transfer pricing.

4. Consolidation of Financial Statements

Challenges:

- Different Reporting Periods: Subsidiaries may have different fiscal year-ends. Aligning these periods is necessary for consolidation.

- Intercompany Transactions: Eliminate intercompany transactions to avoid double counting.

Approaches:

- Uniform Accounting Policies: Ensure all subsidiaries follow uniform accounting policies for consolidation.

- Adjustments: Make necessary adjustments for differences in accounting standards and practices.

5. Cultural Differences

Impact on Business Practices:

- Communication Styles: Direct vs. indirect communication can affect how financial information is reported and interpreted.

- Decision-Making: Hierarchical vs. collaborative decision-making processes can influence financial management and reporting.

Adaptation:

- Cultural Training: Provide cultural training to accounting staff to enhance understanding and cooperation.

- Local Expertise: Employ local experts who understand the cultural nuances and can bridge gaps.

6. Regulatory Compliance

Varying Requirements:

- Financial Reporting: Different countries have specific requirements for financial disclosures, audit standards, and filing deadlines.

- Data Protection: Regulations like GDPR in Europe impact how financial data is handled and reported.

Staying Updated:

- Regular Monitoring: Keep abreast of changes in local regulations through regular monitoring and updates.

- Compliance Programs: Implement robust compliance programs to ensure adherence to local laws.

7. Technology and Systems

Integration:

- Accounting Software: Use integrated accounting software that supports multiple currencies, languages, and accounting standards.

- Data Consistency: Ensure data consistency across different systems and locations.

Advantages:

- Efficiency: Streamlined processes and real-time data access improve efficiency and decision-making.

- Accuracy: Reduces the risk of errors and discrepancies in financial reporting.

In the Case of SASAL, INC.

In SASAL, INC, we use Dynamics 365 and Quick Books & Money Foward; for domestic corporations, SASAL, INC recommends using the domestic accounting tool because the big corporation’s system needs to be customized, so domestic accounting is better for operating actual accounting. Domestic tools are more efficient because they can handle more than just the actual accounting, such as dealing with on-boarding. However, for the analysis of all corporations, SASAL recommends a big corporation’s tool by connecting it to a small corporation’s tool.

In the case of SASAL, INC, the first problem is to set the accounting regulations. For a smooth way, SASAL sets the rules before the transaction is done too much. If you ask a big corporation to fix the regulations, that takes time; therefore, SASAL recommends starting from small by learning systematically.

When you contract SASAL’s counselor service, we are able to show SASAL’s case. Thank you.

Other Articles