Venture Capital plays a crucial role in the startup ecosystem by providing the necessary funds and support for high-potential companies to grow and succeed. While it comes with its own set of risks and challenges, the benefits of VC funding can be significant, helping startups achieve their full potential and make a lasting impact on their industries.

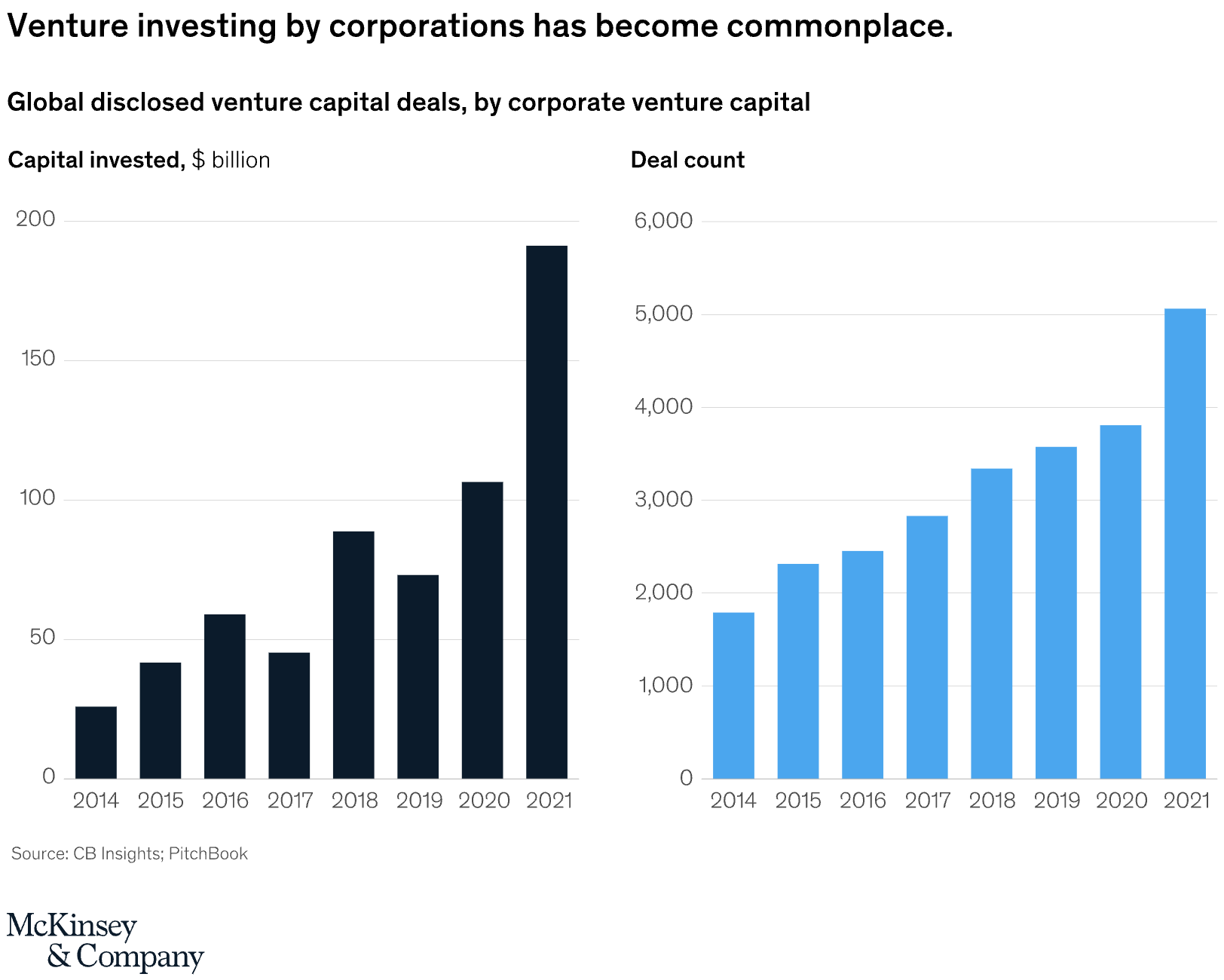

Both Venture Capital and Corporate Venture Capital play crucial roles in the startup ecosystem, but they have different objectives and approaches. VCs are primarily driven by financial returns and invest in a wide range of industries. CVCs, on the other hand, seek to achieve strategic benefits for their parent corporations in addition to financial gains. They focus on startups that can complement or enhance the corporation’s existing business.

The choice between VC and CVC funding depends on the startup’s goals, industry, and the type of support they seek. Startups looking for strategic partnerships and access to corporate resources may prefer CVC funding, while those seeking purely financial backing and broader industry connections may opt for traditional VC funding.

What is Venture Capital?

Venture Capital (VC) is a form of private equity financing that investors provide to startups and small businesses with high growth potential. These investors, known as venture capitalists, typically invest in exchange for equity, or ownership stakes, in the companies. This type of financing is crucial for startups that may not have access to traditional financing options like bank loans.

How Does Venture Capital Work?

- Raising Funds: Venture capital firms raise money from institutional investors and high-net-worth individuals, known as limited partners (LPs). These funds are managed by general partners (GPs) who are responsible for making investment decisions. The process of raising a venture capital fund involves convincing these LPs of the potential returns on their investment.

- Investment Process: Once the fund is raised, the VC firm looks for promising startups to invest in. This involves a rigorous process of due diligence, where the firm evaluates the startup’s business model, market potential, team, and financial projections. If the startup passes this evaluation, the VC firm will negotiate the terms of the investment, including the amount of capital to be invested and the equity stake to be received in return.

- Stages of Investment:

- Seed Stage: This is the initial stage of funding, where the startup is still in the idea or prototype phase. The capital provided at this stage is used to develop the product and validate the business model.

- Early Stage: At this stage, the startup has a working product and some initial market traction. The funding is used to scale operations, hire key staff, and enter new markets.

- Growth Stage: This stage involves larger investments to expand the business further, increase market share, and prepare for an exit strategy. The company is usually generating significant revenue but may not yet be profitable.

- Equity Stake: In return for their investment, VCs receive equity in the company. This means they own a portion of the company and have a say in its strategic decisions. The size of the equity stake depends on the amount of capital invested and the valuation of the company at the time of investment.

- Exit Strategy: VCs aim to eventually sell their equity stake for a profit. This can happen through an Initial Public Offering (IPO), where the company goes public and its shares are listed on a stock exchange, or through an acquisition, where the company is bought by another firm. Another exit option is a buyout, where the company’s founders or other investors buy back the VC’s equity stake.

Benefits of Venture Capital

- Access to Capital: VC provides startups with the necessary funds to grow and scale their operations. This is especially important for startups that may not have access to traditional financing options.

- Expertise and Mentorship: VCs often bring valuable industry experience and strategic guidance to the startups they invest in. This can help the startup navigate challenges and make better business decisions.

- Networking Opportunities: Startups gain access to the VC’s network of partners, customers, and other resources. This can open doors to new business opportunities and collaborations.

Risks and Challenges

- Equity Dilution: Founders must give up a portion of their ownership in the company in exchange for VC funding. This can dilute their control over the company.

- High Expectations: VCs expect significant returns on their investments, which can create pressure on startups to grow rapidly and achieve high valuations.

- Loss of Control: With equity comes influence, and VCs may have a say in major business decisions. This can sometimes lead to conflicts between the founders and the investors.

Examples of Venture Capital Success

Many well-known companies, such as Google, Facebook, and Uber, received venture capital funding in their early stages. This funding helped them grow into the giants they are today. For instance, Google received its first VC investment from Sequoia Capital and Kleiner Perkins in 1999, which helped it scale its operations and eventually become one of the most valuable companies in the world.

The types of the PE Found

Venture Capital (VC)

Venture Capital is a form of private equity financing provided by investors to startups and small businesses with high growth potential. Here are the key aspects of VC:

- Primary Goal: The main objective of VCs is to achieve high financial returns through an eventual exit, such as an Initial Public Offering (IPO) or acquisition. VCs invest in startups with the expectation that these companies will grow rapidly and provide substantial returns on their investments.

- Funding Source: VCs raise funds from institutional investors and high-net-worth individuals, known as limited partners (LPs). These funds are managed by general partners (GPs) who are responsible for making investment decisions. The process of raising a venture capital fund involves convincing these LPs of the potential returns on their investment.

- Investment Process: Once the fund is raised, the VC firm looks for promising startups to invest in. This involves a rigorous process of due diligence, where the firm evaluates the startup’s business model, market potential, team, and financial projections. If the startup passes this evaluation, the VC firm will negotiate the terms of the investment, including the amount of capital to be invested and the equity stake to be received in return.

- Stages of Investment:

- Seed Stage: This is the initial stage of funding, where the startup is still in the idea or prototype phase. The capital provided at this stage is used to develop the product and validate the business model.

- Early Stage: At this stage, the startup has a working product and some initial market traction. The funding is used to scale operations, hire key staff, and enter new markets.

- Growth Stage: This stage involves larger investments to expand the business further, increase market share, and prepare for an exit strategy. The company is usually generating significant revenue but may not yet be profitable.

- Equity Stake: In return for their investment, VCs receive equity in the company. This means they own a portion of the company and have a say in its strategic decisions. The size of the equity stake depends on the amount of capital invested and the valuation of the company at the time of investment.

- Exit Strategy: VCs aim to sell their equity stake for a profit eventually. This can happen through an Initial Public Offering (IPO), where the company goes public and its shares are listed on a stock exchange, or through an acquisition, where another firm buys the company. Another exit option is a buyout, where the company’s founders or other investors buy back the VC’s equity stake.

Corporate Venture Capital (CVC)

Corporate Venture Capital is a form of venture capital where large corporations invest in startups. Here are the distinguishing features:

- Primary Goal: While financial returns are important, CVCs also aim to achieve strategic benefits for the parent corporation. This includes gaining access to new technologies, products, or services that can enhance their operations or provide a competitive edge. CVCs often look for startups that can complement or enhance their existing business.

- Funding Source: CVCs are funded by a single corporation, which acts as a limited partner. The parent corporation plays a significant role in the CVC’s investment decisions and operations. This close relationship allows the parent corporation to leverage the innovations and technologies developed by the startups.

- Investment Process: Similar to traditional VCs, CVCs conduct due diligence to evaluate the potential of startups. However, the evaluation criteria also include the strategic fit with the parent corporation’s goals and objectives. The terms of the investment are negotiated to align with both the financial and strategic interests of the corporation.

- Stages of Investment:

- Seed Stage: CVCs may invest in very early-stage startups to gain early access to innovative technologies and ideas.

- Early Stage: Investments at this stage help startups scale their operations and develop products that align with the corporation’s strategic interests.

- Growth Stage: Larger investments are made to help startups expand their market presence and integrate their solutions with the corporation’s existing operations.

- Equity Stake: In return for their investment, CVCs receive equity in the startup. This equity stake allows the corporation to influence the startup’s strategic direction and ensure alignment with its own goals. The size of the equity stake depends on the amount of capital invested and the valuation of the startup.

- Strategic Collaboration: CVCs often facilitate collaborations between the startup and the parent corporation. This can include joint development projects, pilot programs, and access to the corporation’s resources and customer base. These collaborations can accelerate the startup’s growth and provide valuable insights to the corporation.

- Objective: VCs focus primarily on financial returns, while CVCs seek both financial and strategic benefits. CVCs aim to enhance the parent corporation’s competitive position and drive innovation within the company.

- Funding Source: VCs raise funds from multiple investors, whereas CVCs are funded by a single corporation. This difference in funding sources influences the investment strategies and objectives of each type of investor.

- Investment Criteria: VCs evaluate startups based on their financial potential and growth prospects, while CVCs consider both financial potential and strategic fit with the parent corporation. This means CVCs may invest in startups that align with the corporation’s long-term goals, even if the immediate financial returns are not as high.

- Support and Resources: CVCs can offer more extensive resources and industry-specific expertise due to their connection with the parent corporation. This includes access to research and development facilities, marketing channels, and established customer relationships. VCs, on the other hand, provide general business guidance and connections within the broader investment community.

Strategy Consulting Values to VC and CVC

Market Analysis and Insights

Strategy consulting firms offer comprehensive market analysis, providing VCs and CVCs with deep insights into industry trends, competitive landscapes, and emerging opportunities. This information is crucial for making informed investment decisions. By understanding market dynamics, VCs and CVCs can identify high-growth sectors and potential disruptors, allowing them to invest strategically and stay ahead of the competition.

Investment Strategy Development

Consulting firms assist in developing robust investment strategies that align with the corporation’s long-term goals. This includes identifying potential investment targets, evaluating their strategic fit, and assessing the risks and returns. A well-crafted investment strategy ensures that the corporation’s resources are allocated efficiently and that investments are made in companies with the highest potential for growth and profitability.

Due Diligence

Conducting thorough due diligence is a critical step in the investment process. Strategy consultants perform detailed financial analysis, market validation, and operational assessments of potential investments. This ensures the investment is sound and aligns with the corporation’s strategic objectives. By identifying potential risks and opportunities early on, consulting firms help VCs and CVCs make more informed and confident investment decisions.

Portfolio Management

After making an investment, consulting firms provide ongoing support to manage and optimize the portfolio. They offer strategic guidance to portfolio companies, helping them scale, improve operations, and achieve growth targets. This includes advising on business development, operational efficiency, and market expansion. Effective portfolio management maximizes investments’ value and ensures portfolio companies reach their full potential.

Innovation and Technology Scouting

For CVCs, staying ahead of technological trends is vital. Consulting firms help scout for innovative technologies and startups that complement or enhance the corporation’s capabilities. By identifying cutting-edge technologies and disruptive innovations, consulting firms enable CVCs to invest in companies that can drive future growth and maintain a competitive edge in the market.

Performance Measurement

Establishing metrics and benchmarks to measure the performance of investments is essential for tracking progress and ensuring that investments are delivering the expected returns. Consulting firms develop performance measurement frameworks that help VCs and CVCs monitor the success of their investments. This includes financial metrics, operational KPIs, and market performance indicators. Regular performance reviews allow for timely adjustments and improvements.

Strategic Partnerships and Alliances

Consulting firms facilitate strategic partnerships and alliances between the corporation and other entities, including startups, other corporations, and research institutions. These partnerships can drive innovation, open new business opportunities, and enhance the corporation’s strategic position. By leveraging their extensive networks and industry expertise, consulting firms help VCs and CVCs build valuable relationships that can lead to collaborative ventures and mutual growth.

Regulatory and Compliance Support

Navigating the regulatory landscape can be complex, especially when investing in different countries. Consulting firms provide expertise in regulatory compliance, ensuring that investments adhere to all relevant laws and regulations. This includes understanding local market regulations, intellectual property laws, and industry-specific compliance requirements. By mitigating regulatory risks, consulting firms help VCs and CVCs avoid legal pitfalls and ensure smooth operations.

Exit Strategy Planning

Planning and executing exit strategies is crucial to the investment lifecycle. Consulting firms help VCs and CVCs develop and implement exit strategies through IPOs, mergers, acquisitions, or other means. A well-planned exit strategy ensures that the corporation can maximize its investment value. Consulting firms guide timing, valuation, and negotiation to achieve successful exits and maximize returns.

The Support of the SASAL, INC

To the start-up

SASAL, INC is not VC & CVC; however, we have their connection; when you want to widen the VC connection, we can support you when you are the client.

To the VC & CVC

Before investing, SASAL, INC can check the market situation through business due diligence. First, please create a contract with the counselor service. You are able to save your budget; SASAL supports the buy-side, such as VC or Listed Corporation. Before investing, SASAL, INC can provide daily support through Counselor Service. When you would like to get packaged service, you can contract. Please make use of it. Thank you.

Other Articles

No shortCode found